For a while now I have spoken about the trends in the

operational workforce, and people have been talking about the aging workforce

(expect major impact over the next 7 years), but the talk has only been in one

dimension.

Over the last week as we did analysis across a couple of

industries an “aligning of the planets” into a major market disruptive event

has become clear not just from the “aging” workforce retiring , but from two

additional dimensions.

The diagram below tries to show the 3 converging dimensions

that became clear where speaking with 2 customers and then listening to a few

others.

Looking at this diagram you have 3 clear dimensions, driving

different aspects of the new strategies we seeing in “Smart Facilities/ Plants”

etc., but they all effect each other, and will cause a significant shift in how

we handle experts.

Experts can be in the Operational Process, Production, IT,

Automation, Asset etc.

1/ Reducing Expertise

Capacity (Aging workforce): Nothing new here except the impact of GFC

(global financial crisis) has pushed out the retirement of many people. But as predicted

in Europe that in 2030 there will be an 8.3 million deficit in people entering

the workforce vs retiring or leaving. Other charts show the next 7 to 10 years

will see the acceleration of retirements in industry.

Two big feedbacks in this area:

- People are predicting that the workforce of 2020

will have 30% of experience of the current workforce, does not mean they less

qualified, but their first hand experience in a role or location will be down.

That tacit knowledge vs the explicit knowledge you can learn from text books.

- Two companies just talked about even the

shortage of people hiring into positions even from Gen Y.

One comment from the mining field “I've been told by

engineers on more than one mine site that they just don't run the existing

equipment as well as they used to in the early 1990s. Particularly the big

plant and equipment. This seems to be more an issue of availability of

expertise and training!”

2/ New Digitally Native/

Dynamic workforce: This I have talked about at length, but it is still an

eye opener for many people that the above “ageing workforce” retiring is not

just about the loss of experience (which significant), but the transition. The

new workforce is not the same as the old, and the interfaces, procedures,

approaches will not work, or keep the experts.

- They are digitally native they expect to collaborate,

share, and in the NOW

- They will evolve in roles, careers, and locations

many times to the point that they will not stay in a role/ location for longer

than 2 years. We already seeing this in some parts the world.

- There ability to use tools to execute exceeds to

two pervouse generations, but their tolerance and ability to solve, investigate

work determining execution is reduced. The system should provide the

information and action.

3/ Personnel Efficiency Reduction: This was brought

to me 2 weeks ago and I was surprised as I know in my own work that I do far

more than I did 10 years ago, and effect all parts of the globe so my reach is

more effective.

But in Solomon Benchmarking for refining, which is really

the Refining industry benchmarks by which companies in that industry judge

their performance. Indicated from 1994 to 2012 the Personal Cost Index is

dropping. PCI (Personal Cost Index) is equal to “Personal Cost/ Equipment/

Asset Capacity to Produce “. Over the last 18 years the trend has been that

Asset/ Plant capacity increase has not kept pace with the increase in Human

Overhead cost. Example in 2010 = 23.5 2012= 25.7. Driving strategies to use

fewer experts across wider influence over the total industrial supply chain,

increasing the effective output.

Is this surprising initially probably yes, but when I went

back and looked again, in my role I have increased my efficiency and output, by

leveraging new technologies built into the latest office, communication, and

task execution tools.

But has that same dramatic increase in tools capability to

empower operators and experts to increase their effectiveness happened in the

industrial world, ASM (Abnormal Situational Management Consortium) and others

indicate that we have not increased the empowerment of industrial worker. We

have done integration, we have looked asset performance, process performance,

but in most cases until recently we have not changed the personal experience significantly

to performance tasks.

With the true application of the ASM concepts, going to Integrated

Operational Centers, going to exception based awareness, vs monitoring. Truly

not just making the equipment smart, but leveraging the smart “self aware”

equipment to empower a new level of operational efficiency and increased output

relative to the amount of experts and operational staff.

Also during the same period the both the “mechanical and

operational availability” in refining has dropped.

This is all food for thought, but in so many of

conversations I am having today with leading thought leaders in industrial

companies, the need for innovative ways to effectively use their workers and

experience across their industrial supply chain is “top of mind.”

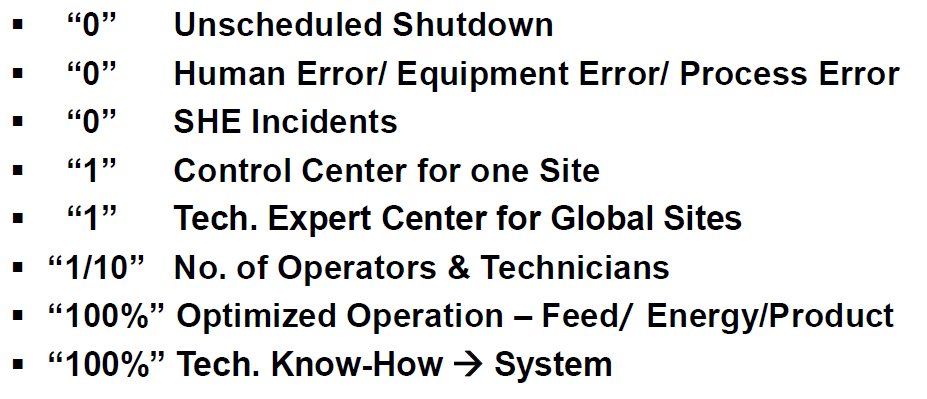

A foundational pillar in an Effective Operational Excellence

Strategy, is the strategy around using experts differently, leading companies

towards the “Virtual Expert Teams” that collaborate on trusted information with

the local teams. Indications are that the operational work-space of 2020/ 25 will have a significant 40% less operational experts across a companies industrial supply chain, with the systems housing the required knowledge to be agile.